| Brackets | Rate | Duty |

|---|---|---|

| £0-£250,000 | 0% | |

| £250,001-£925,000 | 5% | |

| £925,001-£1.5m | 10% | |

| £1.5m+ | 12% |

| Brackets | Rate | Duty |

|---|---|---|

| £0-£425,000 | 0% | |

| £425,001-£625,000 | 5% |

| Brackets | Rate | Duty |

|---|---|---|

| £0-£225,000 | 0% | |

| £225,001-£400k | 6% | |

| £400,001-£750k | 7.5% | |

| £750,001-£1.5m | 10% | |

| £1.5m+ | 12% |

| Brackets | Rate | Duty |

|---|---|---|

| £0-£145k | 0% | |

| £145,000-£250k | 2% | |

| £250,000-£325,000 | 5% | |

| £325,000-£750,000 | 10% | |

| £750,000+ | 12% |

| Brackets | Rate | Duty |

|---|---|---|

| less than £175k | 0% | |

| £175,000-£250k | 2% | |

| £250,000-£325,000 | 5% | |

| £325,000-£750,000 | 10% | |

| £750,000+ | 12% |

New temporary changes to Stamp Duty Land Tax in England and Northern Ireland

Residential rates on purchases from 1 October

If you purchase a residential property from 1st October 2021, you will have to pay Stamp Duty Land Tax (SDLT) on the amount that you pay for the property above £125,000. This means any buyer purchasing a primary residential property up to the value of £125,000 is exempt from paying Stamp Duty.

Depending on your circumstances, the tax thresholds change, for example, the price of the property and whether you are buying an additional property, will impact on the amount of tax you pay.

You can use the below table to work out the SDLT due:

In addition to the above, there is a discount relief for individuals buying their first home from the 1 July 2021. This means that there will be no SDLT payable on first homes up to the value of £300,000 and 5% SDLT will be payable on properties with a value between £300,001 to £500,000. If the purchase price is above £500,000, then the Stamp Duty table above applies, following the rules for those who’ve bought a home before.

Second homes

When it comes to purchasing a second home, the higher additional rates remain with a 3% higher rate on top of these standards. So, if you are purchasing a holiday home up to the threshold value of £125,000 you will pay 3% SDLT. Those buying a second home over the threshold will pay 8% on the portion from £250,001 to £925,000, 13% on the portion from £925,001 to £1.5 million, and 15% on the remaining portion over £1.5 million.

Visit gov.uk for more information

Leasehold sales and transfers

On new leasehold sales and transfers, the nil rate band which applies to the net present value of any rents payable for residential property is £125,000.

Residential properties

Companies purchasing residential property are charged at 15% on properties costing more than £500,000. From 1 October 2021, the SDLT holiday will come to an end and the SDLT regulations will revert to what they were before these temporary changes were announced.

As there are many different types of stamp duty tax, we have created a stamp duty calculator to help you work out how much you will have to pay for the property you buy. Simply fill out the purchase price and see what your tax will be.

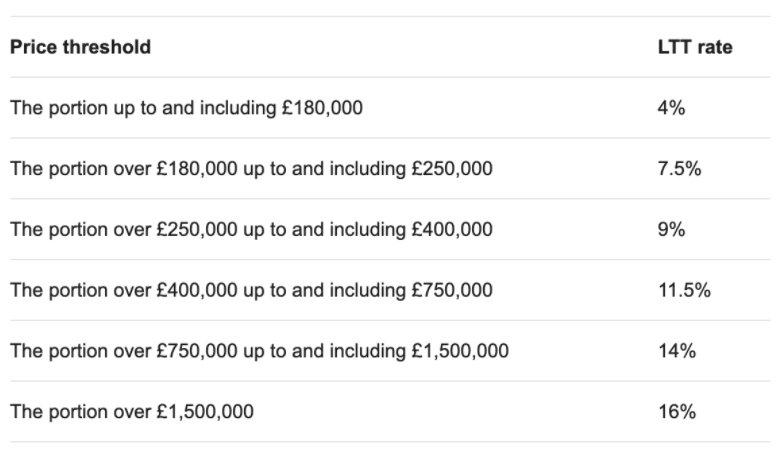

Land Transaction Tax in Wales

Land Transaction Tax (LTT) is payable when you buy or lease a building or land over a certain price in Wales. No tax is paid on the first £180,000 of a property, however, it increases to 3.5% up to £250,000, 5% up to £400,000, 7.5% up to £750,000, 10% up to £1,500,000, with any amount thereafter taxed at 12%.

Higher residential tax rates

As of 22 December 2020, a 4% surcharge applies to transactions involving the purchase of an additional property up to £180,000. This includes second homes and buy-to-let investments. A surcharge of 7.5% applies to properties in the threshold of £180,001 to £250,000, a 9% surcharge on properties between £250,001 and £450,000, 11.5% on properties between £450,001 and £750,000, 14% on properties between £750,001 and £1.5m and a 16% surcharge thereafter.

LTT does not apply to rents payable under a lease for residential property.

If you already own at least one residential property, you may need to pay the higher residential rates when you purchase a residential property.

If you are replacing your main residence, the higher rates may not apply.

Land and Buildings Transaction Tax in Scotland

Land and Buildings Transaction Tax (LBTT) operates slightly differently to SDLT in England and Northern Ireland or LTT in Wales, as it requires buyers to pay tax on amounts between bands, as opposed to the full purchase price of a property.

The following changes have been made as of 1 April 2021.

The first £145,000 will be exempt from tax when purchasing your primary property. Between £145,001 and £250,000, you will pay 2% LBTT, and then 5% on the amount between £250,001 and £325,000, and then 10% on the amount between £325,001 and £750,000 with any amount thereafter taxed at 12%.

Since 30 June 2018, first-time buyers in Scotland have benefited from a relief on LBTT. This raises the zero-tax threshold for first-time buyers from £145,000 to £175,000.

To find out how much you will be required to pay for your new home, simply fill out the form on our Stamp Duty Calculator, selecting where you are buying the property from the dropdown of options.

Stamp Duty FAQs

How do I pay Stamp Duty?

Your solicitor will usually deal with your Stamp Duty return and any related payments, although this can be done yourself. The most important thing is that your Stamp Duty is submitted and paid on time.

When do I pay Stamp Duty?

This is an important question, and it is crucial to know that wherever in the UK you’re buying a property, you have 30 days from the date you of competition to pay the full stamp duty fee. If you take longer, you will be faced with a fixed penalty, and you will pay a tax-based penalty as well as the fixed penalty. It is really important that you pay your Stamp Duty fee on time.

Can I add Stamp Duty to my mortgage?

This mainly depends on your personal circumstances. It is best that you don’t add it to your mortgage, however, many people do as they have to. Adding the Stamp Duty fee to your mortgage will essentially mean that you need to borrow more when your mortgage is being taken out. You will use your ‘extra’ deposit money to pay the Stamp Duty.

I’m purchasing a second home, how much Stamp Duty do I need to pay?

Buyers of additional residential properties, this includes second homes and also buy-to-let properties, will be required to pay a different percentage. Use our calculator above to find out more.

FINE & COUNTRY LIFESTYLE

DISCOVER MORE ABOUT FINE & COUNTRY

NATIONAL MARKET REPORTS

Looking at selling, buying, investing or just interested in the prime property market? Read our latest edition of the National Housing Market Update.

Discover more »

SELLING YOUR PROPERTY

Selling your home is one of the most important decisions you make; your home is both a financial and emotional investment. Find out how we can help »

TAKE THEIR WORD FOR IT

An overwhelming majority of those who had used Fine & Country would recommend our services to a family member or friend, according to our most recent survey taken by members of the public.

To achieve 99.48% positive feedback is a privilege and we will endeavour to maintain this result. We are dedicated to offering the best possible services to every customer, whether buyer or seller, from beginning to end.

INDEPENDENT EXPERTISE

Every Fine & Country agent is a highly proficient and professional independent estate agent, operating to strict codes of conduct and dedicated to you. They will assist, advise and inform you through each stage of the property transaction.

GLOBAL EXPOSURE

With offices in over 300 locations worldwide we combine the widespread exposure of the international marketplace with national marketing campaigns and local expertise and knowledge of carefully selected independent property professionals.

UNIQUE MARKETING APPROACH

People buy as much into lifestyle of a property and its location as they do the bricks and mortar. We utilize sophisticated, intelligent and creative marketing that provides the type of information buyers would never normally see with other agents.

Jo Hawkins said:

Fine & Country Telford office did a great job selling our house which was Grade II listed and not the most straight forward family home to sell. We'd had a few difficultie... Read full review

Review Added: Apr 23rd, 2024Jacob Steele said:

Julian and the team sold our family home with impressive efficiency regardless of market conditions and were highly professional from start to finish, with Julian in particular goi... Read full review

Review Added: Apr 22nd, 2024Michael Keech said:

I cannot recommend Liz and Nicola enough. We went to look at a house that was not quite right for us, but Liz and Nicola, after spending some time with us, showing us around and... Read full review

Review Added: Apr 21st, 2024Rosalie Smith said:

Very professional and supportive throughout the process. Great communication. Thanks! Read full review

Review Added: Apr 19th, 2024OVER 300 LOCATIONS WORLDWIDE

Our International Network

Connecting offices on over 300 locations worldwide, our referral system combines local knowledge and expertise with an international network to find the right buyer for you wherever they are, at the same time as finding you your ideal next move

FINE & COUNTRY SERVICES

FINE & COUNTRY

INTERIOR DESIGN

Access Fine & Country Interior Design to put your property ahead and make it stand out. With expert advice from some of London’s best stylists and designers we will make sure it makes a statement. Or if you’re purchasing with us, let F&C ID help make your new house feel like home by helping you find the very best specialists and designers for property refurbishment. Find out more »

FINE & COUNTRY

FOREIGN EXCHANGE

We have partnered with Rational FX, one of the world’s leading foreign exchange specialists to provide private and tailored currency services for all of our clients buying and selling luxury property around the world. Find out how we can help »

BUYING AGENT SERVICE

We understand that your time is precious, so save the time, money and stress of searching for a property with a buying agent. Also giving you access to off-market and discreetly marketed properties.

MEDIA CENTRE

Our internal Media Centre is a team of experienced press relations managers and copy writers dedicated to liaising with newspapers, magazines and other media outlets to gain extensive coverage for our properties in national and local media.

FINE & COUNTRY PUBLICATIONS

THE FINE & COUNTRY FOUNDATION

The Fine & Country Foundation is dedicated to supporting and funding homeless causes in the UK and overseas. Fine & Country offices organise a range of fundraising events for you to get involved in and/ or support. Find out more about our work here. Read more »

*Please, note: for security reasons, the maps on this website do not provide the exact location of the property and they are provided solely as an indication of area.